US Payroll reconciliation: Reduce stress when balancing W2s and SAP FI

By Patti Friend | 22 July 2020

Blog series part 3 of 3

In Part 1 of this blog series we talked about how the Pay Recon solution could save you hundreds of hours a year in Payroll support and reconciliation. Part 2 focused on example utilities that you could leverage for easing your reconciliation and Payroll investigation. This week, I conclude with some examples related to W2 balancing and balancing to FI.

W2 balancing becomes stress free

When the year-end or W2 season arrives, you can use Pay Recon to ensure that your employee data balances prior to creating your initial W2 run. After creating your W2s, Pay Recon will automatically balance the W2 values against the existing values, and ensure that all four data sources agree, or else will highlight the differences. If you have been using Pay Recon throughout the year as an essential part of your Payroll exit process, then creating W2s becomes a non-event, rather than a stressful part of the year.

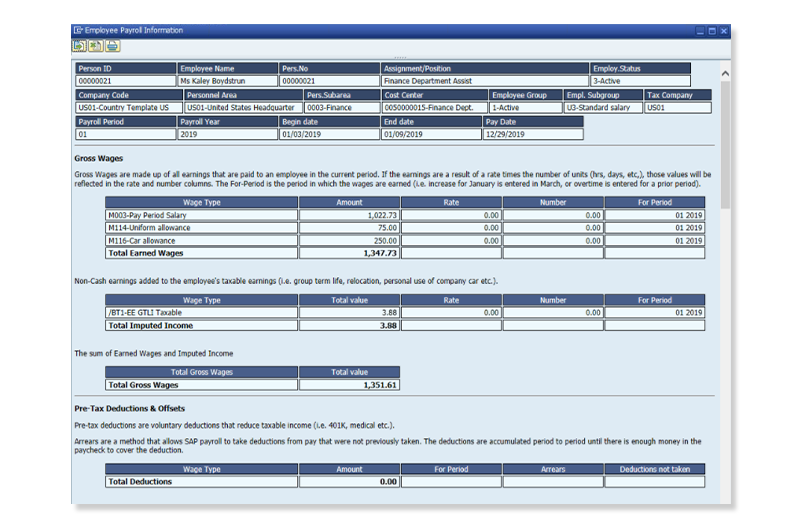

The W2 Explanation Report was designed to help your HR or Payroll department or Employee Help Desk explain where values on an employee's W2 came from. For example, Box 1 on the W2 shows the Federal Taxable Amount, but that's just one number. In the W2 Explanation report, you can show the employee that the Box 1 amount was created by multiple gross pay wage types, imputed income wage types, and pre-tax deductions, which the employee normally sees on their paystub.

Payroll to Finance posting headache goes away

One of the major headaches for a Payroll department is the Payroll to Finance posting function. There are many areas where issues can occur within this process. This often results in many weeks of time-consuming work to reconcile the Payroll system to the Finance posting results. The reconciliation will involve the identification of all payments from the SAP Payroll. These will be individually linked to payments posted to General Ledger, Vendor and Balance Sheet accounts. This process would then need to be followed each subsequent time that the Payroll and Finance systems were to be reconciled.

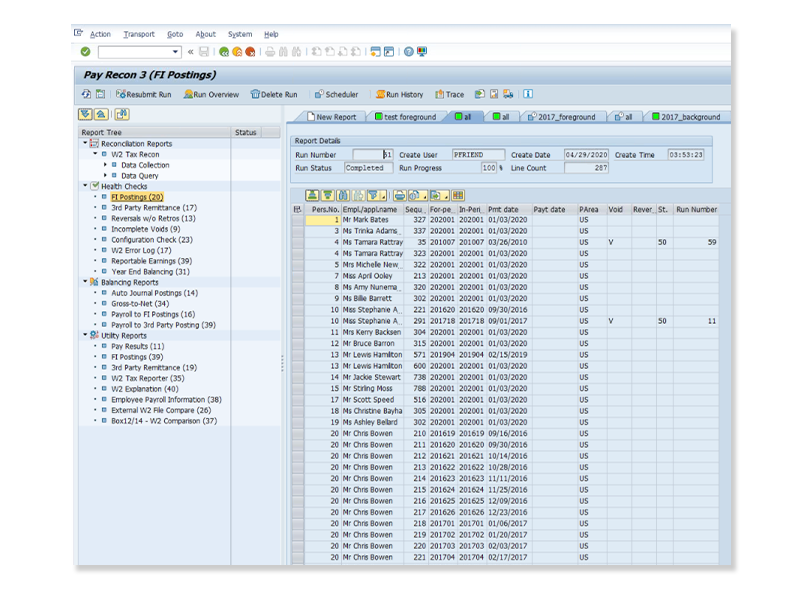

Inside Pay Recon, there are three key reports devoted to Payroll to Finance reconciliation. The FI Posting report in the Health Check section lists all US employees with active Payroll results that have not been posted to FI.

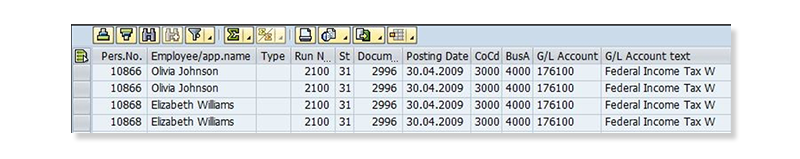

After the Payroll has run, FI posting documents must be created to transfer the Payroll results to the various accounts. After the FI documents are released they update the relevant accounts with the corresponding debits and credits. This FI Utility report can extract the data to provide you with information by accounts, by G/L account, Cost Center, Employee number, WBS element, business number, Fund and Grant.

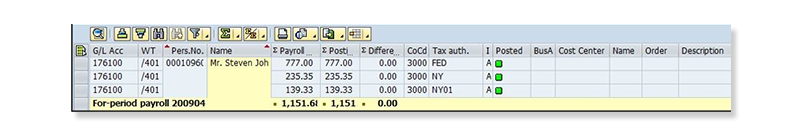

The Payroll-to-FI Posting report, in our Balancing section, has a standard output sorted by Employee, For Period, Wage Type, and Tax Authority. Pay Recon collects this data into each Wage type and posting information (such as Cost Center, G/L Account, Order, etc.) so that retro changes will cancel each other out and show a zero value. If the Payroll amount and the FI posting amount match, then the value in the difference column will be zero.

Empower the HR or Payroll Help Desk Staff to resolve employees inquiries faster

The key aim of the Employee Payroll Information, or EPI, section is to assist the Help desk and Pay office staff with resolving employee queries quickly. The report will give you access to the paycheck activities for the paycheck in question, all in a single view screen.

Some of the areas which can take hours to investigate and explain can be reduced down to minutes and reported in a single screen.

-

Complex Retrospective Payroll Recalculations

-

Pay to Pay comparisons

-

Saving plans deduction changes, retros, arrears

-

Explaining Leave issues

-

Examining Audit Changes/changed Infotypes

-

After-Tax deductions

The report output can be tailored to your company's business processes, and will dramatically speed up issue resolution. The solution is designed to decrease resolution time for Payroll Help desk queries by giving all levels of Payroll staff the ability to quickly and easily investigate and resolve employee Payroll questions.

I hope that you enjoyed this three-part blog series on our Pay Recon solution. Watch this webinar on Tips for SAP Payroll & Tax reconciliation or request your own personalized demonstration of Pay Recon for US SAP Payroll clients.

Patti Friend

Patti Friend joined EPI-USE Labs eleven years ago, having previously spending several years as an SAP HCM Consultant. Patti is responsible for the planning, execution and reflection of all new Quality Assurance cycles for product releases. She is the Quality Assurance team leader for Pay Recon, Variance Monitor, Query Manager 4, and the Cryptographic Library, and she is also part of the Second Line Support team providing assistance to our clients.